SHANGHAI SILVER STOCKS PLUMMET: More Signs Of A Global Run On Silver?

Precious Metals by SRSrocco

Since the middle of June, investment demand for silver has increased considerably. Matter-a-fact, the U.S. Mint suspended sales of the Silver Eagle for two weeks starting on July 12th. When Silver Eagle sales resumed on July 27th, over 2.5 million were sold over the next two days.

Furthermore, the Royal Canadian Mint has put its Gold and Silver Maple Leaf sales on allocation to its Authorized Participants. In addition, India has imported a record 3,824 metric tons (mt) in the first six months of the year. This is up 35% compared to the same time last year. And according to the BankBazzar.com July 28th press release:

Generally, as far as market observation goes, silver imports rise in the second half of the year. The rise in demand in August, is a result of the jewellery making and silverware industry, just before the festive season in Autumn as well as supplying for exports before Christmas.

So, if India imported a record 3,824 mt in the first half of the year, this will only increase in the second half as jewelry and silverware demand pick up considerably due to the festive season in the Autumn.

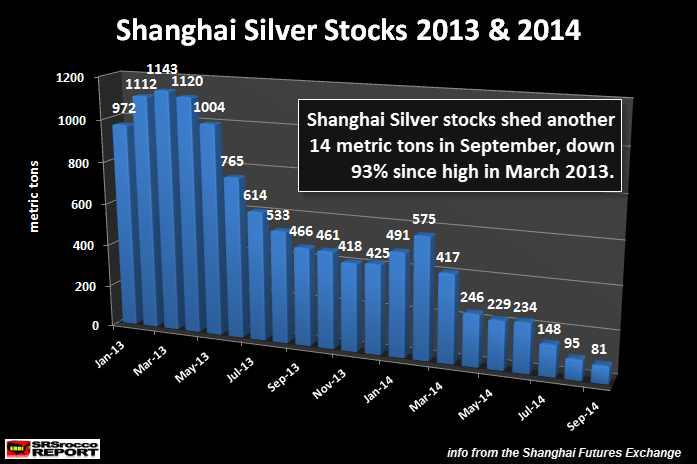

Another factor in the rise in global silver demand is the recent decline in silver stocks at the Shanghai Futures Exchange. Some of my readers have sent me emails stating, “Whatever happened to the silver stocks at the Shanghai Futures Exchange?” Well, let’s first look at my last update from September, 2014:

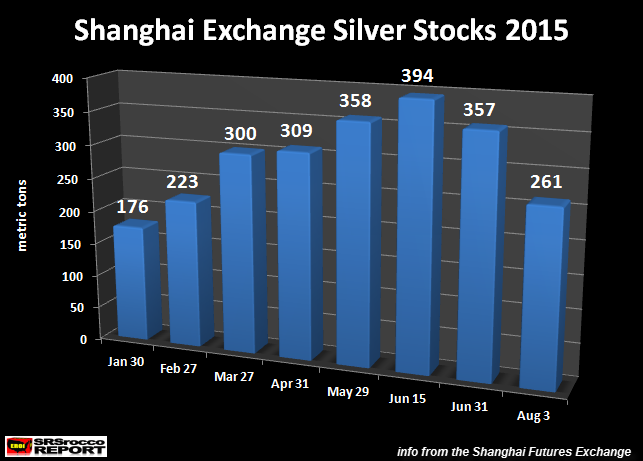

Shanghai silver stocks peaked in May of 2013 at 1,143 mt and fell to a low of 81 mt in September of 2014. Since the last update, silver stocks at the Shanghai Futures Exchange (SHFE) continued to slowly build until they reached a peak in the middle of June.