2014 FULL YEAR RESULTS: Top Primary Silver Miners Lost $1.9 Billion

While two-thirds of the group reported significant write-downs (impairments), two of the largest companies suffered the highest losses. Even though the group experienced record net losses, seven of the twelve actually enjoyed positive adjusted income. Let me explain. Companies report net income and adjusted income. Net income includes various items such as impairments, losses (or gains) on derivatives, hedges, investments or financial exchange losses (gains), and etc.

While these financial items are apart of their profit and loss statement, I like to focus on their adjusted income which removes these items in order to get a better idea of how successful they are at MINING SILVER. As I mentioned before, two of the largest silver producers in the group suffered huge net income losses due to large impairments, but their adjusted income wasn’t as bad.

For example, Coeur stated the largest net income loss of the group at $1.15 billion while Pan American Silver came in second at $545 million in the red. However, the adjusted income for Coeur was -$112 million compared to Pan American Silver at -$20.8 million. Coeur’s large adjusted loss for the year, awarded them with the third highest estimated break-even of the group at $22.38. Which means, Coeur lost an estimated $3.51 for each ounce of silver they sold at an average price of $18.87 in 2014.

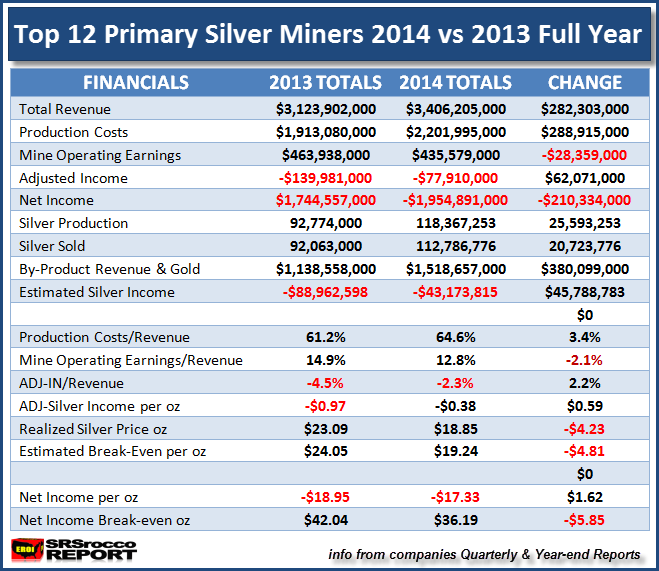

Here is the combined financial data for the top 12 primary silver miners in my group:

As we can see from the table above, the group sold nearly 21 million oz (Moz) more silver in 2014 than 2013, but their total revenue only increased $282 million from $3.1 billion to $3.4 billion. Basically, the group sold 23% more silver in 2014 and was awarded with a paltry 8% increase in total revenue.