Chinese Gold Demand Still Running Extremely High For Summer Months

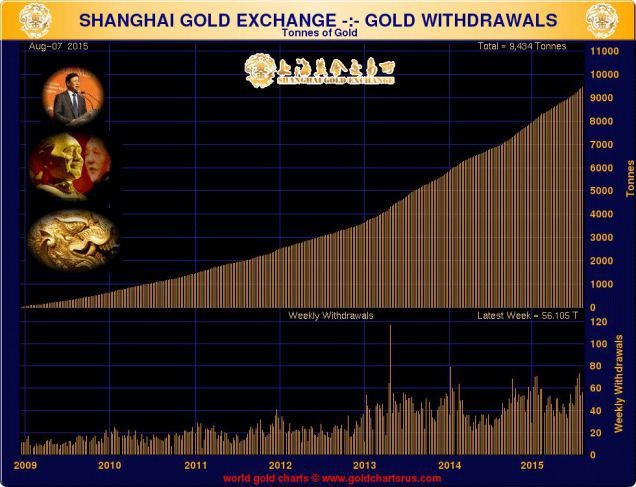

A particular feature of this year's SGE withdrawal figures has been the continuing strength of demand so expressed through the summer months when demand normally falls away. This year weekly demand over the period has been mostly above the 50 tonne mark - indeed it was well over 70 tonnes just three weeks ago - and this is at a time of year when 30 tonnes plus normally represents a strong demand week on the SGE! See chart below from sharelynx.com.

If one checks out the weekly withdrawals bar chart (the lower section), one can see just how strong recent movement through the exchange has been in comparison with previous years.

Interestingly, the Chinese Central Bank - the Peoples Bank of China (PBoC) - has also now started to report monthly updates in its gold reserves (see China gold reserves up 19 tonnes in July. Really?!) which could be seen as adding to overall Chinese demand, although many Western analysts are unconvinced about the accuracy of PBoC statements regarding the size of the nation's real gold reserves.