Precious Metal Vault Storage: Differences Between Unallocated, Allocated and Segregated Storage

If you plan to store gold, silver, or platinum bullion in a vault, you will undoubtedly encounter various storage jargon, such as unallocated gold, allocated gold, and segregated gold, in your research. You may have already noticed that the definitions of these terms may be different for different precious metal custodians and dealers.

Confused? You have come to the right place, as this article will demystify the different ways precious metals are stored in the industry and help you understand which type of bullion storage you should choose.

Understanding Your Motivations With Investing in Gold and Silver

Investing in precious metals like silver and gold bullion is a widely available option in the investment world. However, there are different ways to invest in precious metals and your investment objectives are likely to dictate what type of bullion storage you choose.

“I Want to Protect My Wealth”

Gold and silver have been money for most of humankind’s history. They were often used in the form of coins, bars, and jewelry for wealth preservation.

Unlike government-issued fiat currency that has a poor track record of keeping its value, gold and silver have been the ultimate safe-haven asset throughout history. They cannot be printed out of thin air like paper money and are unlikely to be devalued by monetary inflation.

Buyers of physical gold and silver often have some distrust of fiat currencies, being aware of their abysmal track record at preserving wealth. From their perspective, their buying of gold and silver is akin to redeeming physical precious metals with paper money.

Given that the accumulation of precious metals will eventually require secure storage, physical silver and gold buyers will likely consider storing their metals with a safe deposit box provider or a third-party private vault.

“I Want Price Exposure”

Investors seeking only exposure to the silver or gold price are likely to prioritize capital gains ahead of wealth protection. They are likely to gravitate towards precious metal investment products that allow the convenience of quickly trading (buying and selling) precious metals without the need to take delivery of physical gold or silver.

In addition, such investors are mindful of their potential profit margins and will prefer investment products with little to no storage costs. Therefore, they are also unconcerned if the precious metal investment product allows them to own any physical gold or silver in a vault.

Types of Precious Metal Bullion Storage

Now that we have identified the different motivations of precious metal investors, we will explain the different types of precious metal bullion storage and why certain gold investors may choose them.

Bear in mind that the industry does not agree on a definition of how gold is stored for each of these storage labels. Most definitions address either whether physical gold is present or how gold is physically stored in a professional bullion vault.

Unallocated Storage

If you have been offered a digital or paper gold product with unallocated gold, the strictest meaning is that no physical gold bullion is set aside to back the product. In other words, this paper or digital gold product only has exposure to the gold price.

You may want to scrutinize the prospectus or terms of service of such a product. It would be unsurprising if it said that you will be compensated with currency in the event of any liquidation (either you sell or other scenarios warranting compensation, such as product failure).

Some unallocated storage programs, like the Perth Mint Depository, allow unallocated metal to be converted into physical precious metals, albeit with additional fabrication and storage fees payable.

In the case of The Perth Mint, they state clearly that:

“When buying unallocated, you only pay for the precious metal as there are no fabrication or storage fees.”

It is to be expected that no storage or fabrication fees are payable if the mint does not need to make a special effort to set aside precious metals for the unallocated storage program.

While unallocated gold products may not involve physical gold, they are still sought after because of the smaller bid-ask spreads. This is unsurprising since no costs are associated with managing physical gold, such as vaulting, insurance, and transportation.

Investors seeking price exposure to speculate on the gold price will likely gravitate toward unallocated gold products since they prioritize making a quick profit over long-term wealth preservation.

Pooled Storage

Another way unallocated storage could be described is as pooled storage. We give this type of storage a separate section in this article because pooled storage begins to convey the issue of gold ownership, which differs from our strict definition of unallocated storage above.

Despite no agreement within the bullion storage industry on the definitions of the different types of storage, our research shows that the general consensus regarding pooled storage is that some physical gold is present.

However, using the word ‘pooled’ in the broadest sense could mean that the pooled gold comes from different types of gold owned by various parties. For example, a mint's core business is refining precious metals from gold granules and casting them into gold bars and coins using gold sheets and blanks. Despite their varying forms, gold granules, sheets, blanks, bars, and coins are valuable and recorded as assets on the mint’s balance sheet. In this context, pooled gold storage could involve gold appraised in a currency but in various forms.

Another possibility is if financial institutions store gold in a vault and offer their stored gold to back a gold investment product for an agreed interest return. In this case, the pooled gold behind the gold product could be owned by different parties. If undeclared, buyers of the gold product will never know the existence of these behind-the-scenes agreements that may impact their investment.

Regardless of how such an investment product is marketed to suggest that you, the buyer, will own gold, you are unlikely to have legal ownership. Instead, you are an unsecured creditor having a claim on the gold since the respective contributing parties legally own the gold.

Having a claim on the gold is similar to sharing ownership of a gold bar. For example, a 1-kilogram Credit Suisse gold bar could be ‘owned’ by 1,000 investors, each having a claim to 1 gram of gold. There is simply no way to identify which gram of gold you own.

Moreover, unless otherwise stated explicitly in the prospectus, pooled storage programs do not necessarily guarantee full gold backing.

The cost of operating a pooled gold storage program would be lower than one where individual investors own specific gold coins or bars since there is no need to track individual gold ownership. IT systems would be less complex, and manpower costs would be lower.

Therefore, the fees for pooled gold storage are often lower than gold storage programs where you own specific gold bullion bars and coins.

While pooled storage often has gold, it comes with high counterparty risk, as you do not own the gold, and it depends on how the gold product administrator manages the pooled gold inventory.

In our opinion, pooled gold storage is not necessarily a step up from unallocated storage as it seemingly exists to assure investors of some gold backing without ownership and there are doubts over the assurance’s usefulness given the obscure nature of the physical gold behind it.

Once again, investors prioritizing gold price exposure who are not concerned about gold ownership and long-term wealth protection may prefer pooled storage.

Allocated and Fully Allocated Storage

‘Allocated storage’ is frequently used by bullion dealers or gold investment products to convey gold ownership. However, this is not necessarily true, as the word ‘allocated’ means that gold has been set aside.

Allocated storage may not necessarily mean full gold backing since some gold companies use ‘fully’ allocated storage to emphasize complete gold backing.

What is concerning is that gold ownership is often associated with allocated gold storage, with ownership defined differently.

For example, one company’s allocated gold storage allows you to “own the whole bar” of gold, but upon withdrawal, you will receive a “near-identical” form of gold. What this means is that you could buy and store a 1-kilogram gold bar for years and only know the bar’s brand and serial number only upon withdrawal.

Therefore, while the company claims to set aside a 1-kilogram gold bar when you purchase, no specific bars are assigned to you until withdrawal. Only then is a near-identical gold bar given to you, subject to the availability of your purchased gold bar.

In such allocated storage programs, you will likely have account statements showing that you own a certain quantity of 1-kilogram gold bars. Even if it states the brand of the gold bar, it gives little comfort of true gold ownership because which of the thousands of 1-kilogram PAMP Suisse gold bars in the vault do you own?

The operator of such a gold storage program is merely assuring you that your gold bar is somewhere within gold bar stacks in the gold vault, and you will only know the exact bar upon withdrawal.

This type of storage program begs the question, “Who is the legal owner of the gold bars that have not been requested to be withdrawn?” The owner will likely be the company operating the bullion storage program, not you.

Therefore, while allocated storage may offer some wealth protection from owning gold coins and bars, you may not have legal ownership of physical gold until withdrawal. Such storage programs may work if the custodian has robust and transparent gold auditing processes that ensure the full allocation of gold bars for every customer. However, this depends on the integrity of the company’s management and its decisions, even more so during times of crisis.

Regardless, substantial counterparty risk exists if you do not have legal ownership during storage.

Segregated Storage

Segregated storage is often marketed as an improvement over allocated storage programs, as it identifies specific gold bars that customers own.

It is important that you do your due diligence research and not wholly accept that all segregated storage programs are the same. In some instances, segregated storage could just mean that your gold is stored in its own physical location and not comingled with other customers’ gold.

If your segregated storage statements do not show unique identifiers (e.g. serial numbers) for your gold, you may not own the gold even though they are physically stored in a segregated space within the vault.

Unique identifiers are essential, especially for gold bullion coins which do not have serial numbers. It ensures that if you buy gold bullion to be stored in a vault, you will receive the same gold coins or bars when you take physical possession someday.

However, it is important to understand that segregated gold storage may not necessarily mean that all your gold holdings are stored in a single, separate space, like in a safe deposit box. Such an arrangement may not be available without higher storage costs as it is not the best way to store gold in a vault efficiently.

Instead, segregated gold storage should ensure that all your gold is uniquely identified. If accompanied by a well-designed storage system, this automatically allows its physical location to be found.

Segregated gold storage is most likely to provide physical ownership among the other types of bullion storage. However, given the higher level of safety to customers, segregated gold storage may have costlier storage fees if a small vault operator does not have economies of scale with the vault storage.

Segregated gold storage is most suited to gold owners seeking wealth preservation since they prioritize long-term gold ownership.

The 2 Most Important Criteria for Gold Ownership

Now that you have understood the difference between the various types of gold storage, we address the issue of gold ownership, which is still not properly addressed.

True ownership of your gold stored with a third-party vault requires two important factors:

#1 – Unique identification of asset

As briefly mentioned in the segregated gold storage section above, it is important that your gold bullion can be uniquely identified when stored in a vault.

A unique identifier is the basic way something can be identified as belonging to you. For example, an apartment has a unique address, allowing you to own it. If there is no identifier, it would be difficult to describe the property. If the identifier is not unique, there could be contentions by multiple parties claiming to own the same property.

In the same way, your gold bars or coins in vault storage must be uniquely identifiable for you to claim ownership. Without unique identifiers, a gold storage operator can show the same 1-kilogram gold bar to multiple customers and say they own it.

Therefore, if the statement from your gold storage provider does not show your precious metals with unique identifiers, such as serial numbers, your legal ownership of the gold bullion is not guaranteed, even if they claim that you are enrolled in a fully allocated or segregated gold storage program.

It is essential that you examine such details and look beyond the storage terms the industry throws at you.

#2 – Legal mechanism to transfer ownership

While uniquely identifiable assets are needed for gold ownership, it is also important to scrutinize the strength of your ownership claim once you have handed your gold coins and bars to the gold storage provider.

The basic question is, “How am I assured that I am the legal owner of my stored precious metals?”

Many bullion storage programs address this question by offering customers certificates of ownership. It is irrelevant whether these certificates are digital or in paper form. It is important to understand that the storage provider, which is a private company, issues them.

Certificates of ownership issued by private companies are akin to a company issuing its paper currency. They are recognized and accepted only in good times when the company is doing well and the currency can circulate. However, if the company goes bankrupt, the currency becomes worthless as the confidence to accept it plunges in the market.

In the same way, certificates of ownership may be fancifully designed to look official and to gain customer confidence. However, they cannot be upheld in court as proof of legal ownership of gold held in a private company’s gold storage program.

Your legal claim is even weaker if the certificate does not state which uniquely identified gold bars or coins belong to you. Without the certainty of legal ownership, you are relegated to being an unsecured creditor of the gold storage provider in the event of bankruptcy. Moreover, without proof of customers’ ownership, stored bullion could also be stored as part of the company’s assets under their balance sheet.

The solution to this problem is already provided in the business world. When you buy something, you are often given a receipt or invoice. You cannot be accused of shoplifting if you leave a shop possessing an invoice because it shows that you own the purchased item.

Similarly, your gold storage program can truly be only a custodian of your precious metals if they give you an invoice acknowledging that you own the gold bullion that was handed to them for storage. The invoice should also list uniquely identifiable assets belonging to you.

Such a practice protects you as a customer, as commercial invoices can be held in court as proof of ownership. The law also incriminates any falsification of invoices, disincentivizing any antics from your gold storage provider.

An invoice stating that the gold storage provider received your specific precious metals for safekeeping also ensures that they do not own your gold. Instead, they are only a custodian, and your gold bullion is not under the company’s balance sheet.

How Silver Bullion Stores Your Precious Metals

The two abovementioned criteria for gold ownership are not practiced by many gold storage providers. Unlike them, Silver Bullion’s S.T.A.R. Storage program had both criteria since day one.

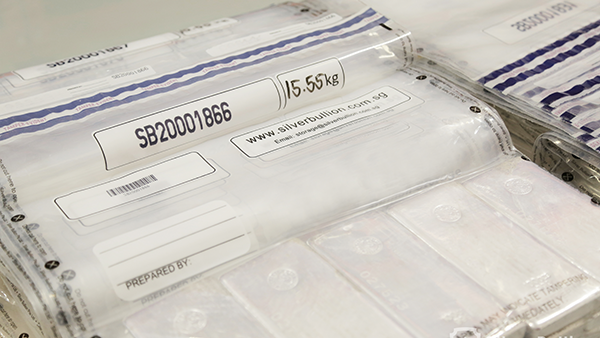

All precious metals stored under S.T.A.R. Storage are sealed in uniquely serial-numbered tamper-evident security bags, also known as parcels, allowing customers’ assets to be identified. They also receive a photograph of their sealed bullion uploaded to their S.T.A.R. Storage account.

When customers buy and store or transfer-in precious metals into S.T.A.R. Storage, they also receive invoices for their storage orders. These invoices state the unique parcel numbers in which customers’ bullion are sealed, ensuring that they own their gold, silver, or platinum bullion.

When you store precious metals in S.T.A.R. Storage, Silver Bullion is merely a custodian of your precious metals, which are not on our company’s balance sheet. In this way, your assets cannot be claimed by any of the company’s creditors in the unlikely event of bankruptcy. Instead, your wealth is truly protected.

S.T.A.R. Storage customers can also easily check their precious metal holdings by auditing against the S.T.A.R. Storage Parcel Ownership list, which shows all customers’ stored bullion. This list is anonymous, only listing customer account numbers and not their names.

The Parcel Ownership List is the same document used in our quarterly bullion audits by external auditors and Singapore Customs (for bonded storage bullion). Our bullion audit reports are also transparently published on our website.

Customers are welcome to contact Silver Bullion for an in-person bullion audit of their precious metal holdings. All visits to the vault are by appointment.

S.T.A.R. Storage customers’ bullion are stored in The Safe House vault within our headquarters, The Reserve.

Conclusion

When considering storing gold with third-party private vaults, it is important to look beyond marketing jargon like pooled, allocated, and segregated storage and understand what really matters: ownership. As you research the differences between unallocated and allocated gold or segregated and allocated gold, understanding if you are the legal title owner of your bullion will be the crucial determining factor in selecting a vault storage program. We believe that S.T.A.R. Storage has the best processes in place to make you the legal owner of your stored bullion.