How Much Gold Did Singapore Buy in 2023?

The World Gold Council (WCG) hailed 2023 as another year of "blistering" central bank gold buying. Sovereign gold purchases through their central banks were at 1,037 metric tons, a mere 45 metric tons short of the 2022 record.

Singapore’s central bank, the Monetary Authority of Singapore (MAS), was an active buyer of gold in 2023, a return to the gold market since its last purchase in June 2021.

Singapore Was the Third-Largest Net Gold Buyer in 2023

As we stepped into 2024 and all central bank gold purchases were tallied, Singapore emerged as the third-largest net gold buyer in 2023. The Monetary Authority of Singapore added 76.5 metric tons (MT) of gold to Singapore’s gold holdings.

According to World Gold Council data, Singapore had 153.74 metric tons of gold at the end of 2022. Thus, the 76.5 metric tons of gold added in 2023 represented a significant 49.8% rise in Singapore’s gold reserves. The Southeast Asian city-state now has 230.02 metric tons in gold reserves.

Fan Shaokai, WGC’s head of Asia-Pacific excluding China and its global head of central banks, said in a Straits Times interview, “Central banks continue to value the benefits that gold can bring to their reserve portfolios – diversification, downside protection and liquidity. For Singaporeans, it means that their currency and economy have even more layers of protection against an uncertain world.”

Singapore’s Buying Activity in 2023

According to MAS data, the central bank bought gold in 7 months of the year, namely in January, February, March, May, July, August, and September.

Singapore buying 44.62 tons of gold in January was the nation’s second-largest gold purchase ever in one month. Singapore’s first gold purchase of 100 tons from South Africa in 1968 was the biggest.

Singapore’s other recent addition to its gold reserves was in May and June 2021, when a total of 26.35 tons were bought.

In response to media queries in 2021, the MAS said that the increase in gold holdings is a result of "continuous and ongoing efforts by MAS to ensure that the official foreign reserves (OFR) portfolio remains well-diversified and resilient through economic and market conditions."

When the buying of gold in 2023 by the Monetary Authority of Singapore is viewed quarterly, the majority of gold added to Singapore's total reserves was in the first quarter, with 68.68 tons purchased. This was followed by the third quarter and second quarter, with the gold purchase amounting to 4.9 tons and 2.94 tons, respectively.

No gold was purchased by Singapore's central bank in the fourth quarter.

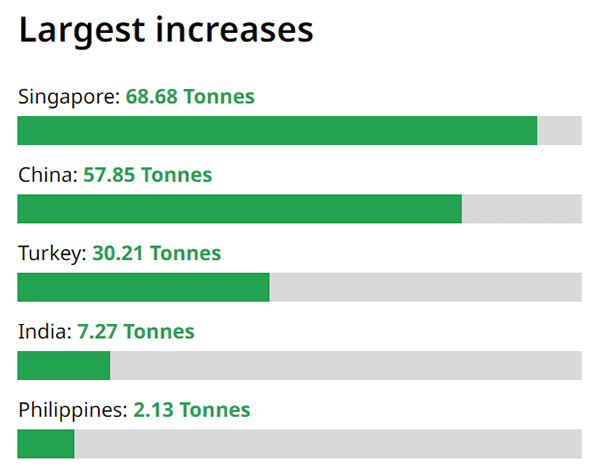

Singapore was the largest gold buyer in the first quarter of 2023. Source: World Gold Council

Singapore Also Sold Some Gold in 2023

MAS data showed that Singapore sold a total of 1.23 tons of gold – with 1 ton sold in June and 0.23 tons sold in December. According to the World Gold Council, the latter sale was the fifth largest globally in the fourth quarter. Gold prices reaching new highs in December could be a reason for the central bank’s gold sale in the year's final month.

2023 was also the first year Singapore sold some gold from its gold holdings.

Singapore gold reserves. Image source: Channel News Asia

Ranking Singapore’s Gold Reserves

At 230.02 tons, Singapore gold reserves are now the 23rd largest in the world.

Among ASEAN nations, Singapore’s gold reserves are the second-largest, just 14.14 tons behind first-placed Thailand. Here are the total gold holdings of ASEAN nations for comparison.

| Country | Gold Reserves (metric tons) | WCG Global Rank |

|---|---|---|

| Thailand | 244.16 | 22 |

| Singapore | 230.02 | 23 |

| Philippines | 164.77 | 26 |

| Indonesia | 78.57 | 42 |

| Cambodia | 42.49 | 50 |

| Malaysia | 38.88 | 53 |

| Myanmar | 7.27 | 83 |

| Laos | 0.88 | 98 |

| Brunei | 4.53* | NA |

| Vietnam | NA** | NA |

*Brunei gold reserves data is not available from the World Gold Council. Trading Economics data was used instead.

** Vietnam gold reserves data is not available from the World Gold Council.

Among developed nations, Singapore now has more gold than Belgium, Sweden, South Korea, Australia, Denmark, Finland, Norway, and Canada.

Why Central Banks Buy Gold

International central banks typically hold a variety of assets as part of a country’s reserves. These include foreign currencies, government bonds, the International Monetary Fund’s Special Drawing Rights (SDRs), and gold.

Central banks may buy gold to diversify the country's reserves depending on the perceived strength or weakness of the global economy. Gold is often seen as an inflation hedge resulting from currency debasement, as it has a finite supply that cannot be created out of thin air like fiat currencies.

Besides Singapore, other central banks have been buying bullion gold bars in recent years. Since 2010, central banks have been net buyers of gold annually. Market observers opined that the increased gold demand coincided with the decline of the U.S. dollar as the dominant world reserve currency.

De-dollarization, a process to move away from U.S. dollar dependence, is also frequently cited as a reason for gold accumulation by central banks. With the emergence of a multipolar world, where U.S.-centric and China-centric worlds jostle, gold is seen to have an increasingly important role in this multi-polarization. Any upcoming new global reserve currency (or currencies) will likely need substantial gold holdings to instill global confidence.

Despite gold playing a reduced role in the monetary system, it continues to be one of the most trusted reserve assets worldwide as it carries no credit or counterparty risks. Gold is a neutral asset that does not fly the flag of any nation. Its value is internationally recognized regardless of its shape or form.

Central banks’ renewed interest in gold since 2010 is a sign that the dollar’s days as the dominant reserve currency are numbered, and the rest of the world is stockpiling gold as insurance for the uncertainties ahead.

"Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted."

— Alan Greenspan

According to the World Gold Council, central banks now hold a fifth of all the gold ever mined – approximately 35,000 metric tons of the precious metal, usually in 400 oz gold bars. Central bank interest in gold is undeniable, given the record gold tonnage purchased in 2022 and 2023. It remains to be seen if this trend persists in 2024 and beyond.

Singapore, An Attractive Jurisdiction to Store Gold

For a country with a total land area of 734.3 square kilometers, about 0.9 times New York City’s size, Singapore’s gold reserves add to the country's fiscal strength and, thereby, its attractiveness as a destination for storing gold and other precious metals.

Unbeknownst to many, Singapore is one of the few countries with no net debt today. It is a creditor nation, owing its fiscal sustainability to the farsightedness of the country’s leaders.

The Singapore Government adheres to a simple strategy: Prudent spending and saving surpluses in good years help with deficits incurred in bad years. This conviction and the government’s constitutional requirement to run a balanced budget allow Singapore to accumulate surpluses that are invested with the country's sovereign wealth funds like Temasek Holdings and the GIC.

The results of Singapore’s fiscally sustainable strategy are apparent to all. Today, Singapore is one of the best places for business, with world-class infrastructure, and one of the safest countries in the world.

If you are planning to diversify your gold holdings beyond your country of residence, Singapore should be one of your top considerations for storing gold in Asia.