Types of Gold Investments

It is no secret that global central banks have been net buyers of gold since 2010, becoming a major source of gold demand annually. Since then, central bank gold buying has reached record levels in 2022 and 2023, with 1,083 metric tons and 1,037 metric tons, respectively. This trend begs the question of why central banks are buying gold at a blistering pace.

Gold has been known throughout history as an excellent hedge against inflation. It is also one of the safest and most trusted assets, given its high recognizability internationally. While there is a greater chance of fiat currencies being devalued to the point of worthlessness, there has never been a time when gold had no value. The yellow metal has always been highly regarded and widely accepted as an excellent store of value.

If you are new to gold investing and are looking for different ways to invest in gold, this article is a primer on the types of gold investments available in the market today. We also provide our analysis and recommendations on the best ways to invest in gold safely based on our years of experience as a precious metal dealer.

Physical Gold / Gold Bullion

In our opinion, the easiest and safest way to invest in gold is to buy physical gold bullion, like gold bars and coins. Physical gold held in your possession or stored in a trusted gold vault is unaffected when the global economy experiences financial crises. Unlike paper gold assets, which we will discuss later, physical gold has no counterparty risk. Its value does not depend on any promises to be fulfilled by external entities (e.g. banks, gold funds, gold mining companies, etc.).

Gold bullion can easily be stored in safe deposit boxes or precious metal vaults for the long term as a wealth preservation asset and an inheritance for posterity.

Many countries, like Singapore, have exempted investment-grade gold from sales taxes and value-added taxes (VAT), recognizing gold's monetary value as similar to cash.

Buying gold is also easy. You visit a reputable gold dealer, pick out your gold bullion, make payment, and leave with your gold.

You can consider buying gold bars or coins to add to your investment portfolio. Investment-grade bars and coins are often produced with a 99.99% gold purity or fineness. However, there are some exceptions, like the American Gold Eagle coin, which has a 91.6% gold fineness.

Next, we will explain the differences between buying bars and buying coins.

Why Buy Gold Bars?

Gold bars are probably the most efficient way to invest in gold. A general rule is true in the gold market: the larger a bullion is, the lower the price premium (the amount you pay above the gold spot price). The converse is also true: the smaller a bullion is, the higher the price premium.

Gold coins are mostly minted to a weight of one troy ounce (or 31.1 grams), although there are semi-numismatic gold coins that are produced with higher weights. Therefore, the only way to buy gold bullion at lower premiums would be to buy gold bars since they are commonly produced in higher weights like 100 grams, 1 kilogram, and even 400 troy ounces (12.4 kilograms).

For example, a one-troy-ounce (Oz) Canadian Maple Leaf gold coin may be sold at about a 3.1% premium above the gold spot price. However, the larger 100-gram gold bar is sold at a lower premium of 1.7%.

Therefore, if you plan to buy gold bullion as a long-term investment or for wealth preservation, buying gold bars will save you more money in the long run. You may even be able to add more ounces to your gold hoard with the difference!

While gold bars may be more cost-efficient than gold coins, you should be aware of some nuances. The gold industry produces two types of gold bars: gold minted bars and gold cast bars.

Minted gold bars are designed by gold mints and refineries with gifting and collecting in mind. Therefore, gold minted bars are often produced with intricate designs with mirror or frosted finishing. They are also sealed in well-designed plastic blister packaging with the assay certificate printed behind them. Due to the extra workmanship in the gold bar's design and packaging, minted bars usually have a higher premium than cast bars.

Examples of gold minted bars include the PAMP Lady Fortuna and Lunar Series gold bar and the Argor-Heraeus Kinebar.

A PAMP Lady Fortuna Certicard gold minted bar

Gold cast bars are designed specifically for the premium-conscious investor. They are rough in appearance, often produced straight out of a mold with minimal polishing. It is normal for gold cast bars to have blemishes like scratches and indentations. The lower premium on cast bars also accounts for their rougher appearance. Regardless, gold cast bars are still produced accurately to the required weight and gold purity like gold minted bars.

While gold cast bars may not be sold with original packaging, precious metal dealers often provide simple plastic sleeves when they are purchased, accompanied by their paper assay certificates.

Examples of gold cast bars include the Valcambi 100-gram cast bar and the Heraeus 100-gram cast bar.

A Valcambi 100g gold cast bar

Another advantage of cast bars is that they are often more storage-efficient, taking up less space within a safe since they do not have any bulky packaging.

Further reading: How to Buy Gold Bars: A Comprehensive Guide for Investors

Why Buy Gold Coins?

Besides gold bars, gold coins are also a popular way to invest in gold. The term 'coin' is exclusively used for round-shaped gold bullion that is minted by a sovereign or government mint. They are legal tender, having a face value denominated in the currency of the issuing country. The face value of a coin is determined by its sovereign mint. For example, the popular 1 Oz Canadian Maple Leaf gold coin has a legal tender face value of CAD $50, while the 1 Oz UK Britannia gold coin has a £100 face value.

Additionally, the face value of a gold coin differs according to its weight. For example, a ½ oz Canadian Maple Leaf gold coin has a CAD $20 face value.

Unlike gold rounds, circular-shaped gold bullion produced by private mints, gold coins often have the advantage of being considered for VAT or sales tax exemption by governments. For example, the Singapore government only considers investment-grade gold bars and coins as tax-exempt, not gold rounds. Similarly, UK residents have tax benefits when they invest in UK Britannia gold coins, a product of the United Kingdom's Royal Mint.

Unlike gold bars, which are commonly produced in higher weights such as 50g, 100g, 1kg, or 400oz, gold coins are often minted to a weight of 1 troy ounce. Gold bullion coins produced to higher weights are uncommon and may be deemed semi-numismatics (semi-collectibles), which command higher premiums than investment-grade gold coins. As mentioned, buying gold bars is the way to go if you seek lower premiums than the 1oz gold coins.

Gold bullion coins can be produced in smaller weights, which is uncommon for gold bars. For example, the Canadian Gold Maple Leaf coin is minted in sizes such as 1⁄2 oz, 1⁄4 oz, 1⁄10 oz, 1⁄20 oz, and 1 gram. While smaller gold coins carry high premiums, many investors purchase them for unique reasons. These small coins are highly portable and can be slipped into a wallet, becoming an emergency source of funds. Given their smaller value, they can also be easily traded for daily essentials in a crisis.

Gold coins are commonly shipped in 10-piece plastic tubes of varying designs from these respective sovereign mints. These coin tubes are easily recognizable within the bullion industry and experienced gold investors. For example, gold coin tubes from the Royal Canadian Mint have a red cap, while the UK Royal Mint's coin tubes have a yellow cap.

Most gold bullion coins are not individually encased in plastic coin capsules. However, certain bullion dealers, like Silver Bullion, may include a plastic coin capsule with your bullion coin purchase. So far, only bullion coins from the Perth Mint, such as the Gold Kangaroo coin and their Lunar Series coins, are encased individually in coin capsules.

Some popular and highly recognizable gold coins include the American Gold Eagle, Canadian Gold Maple Leaf, Austrian Philharmonic, Australian Kangaroo, UK Britannia, Chinese Panda, and South African Krugerrand.

Further reading: Best Gold Coins to Buy for Investment

Gold Rounds

Gold rounds are privately minted, coin-shaped bullion products made from gold. They are similar to gold coins in size and weight but differ in that they are not considered legal tender and do not have a face value.

Produced by private mints, gold rounds are not as recognizable as coins worldwide and often attract value-added taxes (VAT) in many countries. The lack of tax exemption puts rounds at a disadvantage, price-wise, in many countries, thereby further disincentivizing investment purchases. Their rarity in markets worldwide tends to relegate gold rounds to collectibles that command higher premiums than investment-grade bullion.

However, gold rounds are popular in certain markets, such as the United States, where more private mints thrive, making rounds often cheaper than gold coins. In terms of design, gold rounds come with different interesting designs that may pique the interest of investors compared to the unchanging designs of gold coins from government mints. For example, the popular John Wick movie series spawned an exclusive 1oz Continental gold round produced by APMEX in partnership with Lionsgate.

Examples of gold rounds include the Englehard American Prospector gold round, the Golden State Mint Incuse Indian gold round, and the BitPay Bitcoin round.

Further reading: What Are the Differences Between Coins and Rounds?

Gold Jewelry

Investing in gold jewelry can be an alternative to buying gold bullion, but it has its own pros and cons. While it provides the dual benefits of being a wearable asset and a store of value, it also presents challenges related to cost and liquidity.

Like gold bullion, gold jewelry is also a store of wealth. It is popular in markets such as India, China, and the Middle East, where jewelry is often handed down to the next generation as an inheritance.

However, one of the biggest downsides is the high premiums associated with gold jewelry. In addition to the gold content, you pay for craftsmanship, design, branding, and retailer markups, which can significantly exceed the intrinsic value of the gold itself. These additional costs usually do not appreciate and are often lost when selling the jewelry.

Jewelry is often resold based on its gold content (by weight), not on its artistic or design value, unless it is a rare or highly sought-after designer piece. The resale price may be much lower than the original purchase price due to the loss of craftsmanship value.

Gold jewelry is not always pure gold. Many pieces are made from 14k or 18k gold, which contain alloys to strengthen the material. This means you are not getting 100% gold, which reduces the value in terms of pure gold investment. High-karat or 24k gold jewelry does exist, but it is often more expensive.

Additionally, the value of some gold jewelry, particularly designer or branded pieces, may be affected by trends. What is fashionable today may not be in demand in the future, and this can impact its resale value.

Gold Bullion Jewelry

Gold bullion jewelry is considered a better investment than standard gold jewelry for several reasons. It is designed to maximize the gold content while minimizing other costs, such as craftsmanship and design premiums.

Bullion jewelry is often made with a high gold purity of 22k or 24k, focusing on maximizing the actual gold content. It are also designed simply to reduce workmanship costs and allow easier valuation during resale, thus improving liquidity compared to conventional jewelry.

Some gold investors also know that gold jewelry has been excluded from government gold confiscation events, such as the U.S. Executive Order 6102 in 1933. Moreover, gold jewelry does not require reporting as it is not considered a financial asset under U.S. law. Bullion jewelry is an attractive option if investors face potential gold confiscation risks in countries they are exposed to. It mitigates the risks without the high premiums of conventional gold jewelry.

However, bullion jewelry may attract the VAT or sales tax in many countries as they are not differentiated from standard jewelry by the government, making their costs higher than bullion coins and bars.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are a popular way to invest in gold without physically owning the metal. ETF buyers own shares or certificates under their names, giving them price exposure to gold. They do not take any physical delivery of gold.

Gold ETFs, a type of paper gold, can be bought and sold easily on stock exchanges via a stock brokerage account or an investment app, making them highly liquid to transact during market hours, much like trading on the stock market.

The gold ETF price tracks the gold spot price, and no additional premium is added to the spread between the fund's quote bid/ask buying and selling prices. Moreover, since gold is not physically delivered, paper gold investors do not incur any storage, logistics, or insurance costs when investing in a gold Exchange-Traded Fund.

According to the World Gold Council (WCG), gold ETFs account for approximately one-third of the global demand for gold as an investment.

Gold ETFs typically charge an annual management fee, known as the expense ratio. While these fees are generally low, they can eat into long-term returns compared to holding physical gold. However, higher costs can be incurred if your investment amount is large. For example, GLD, the largest gold ETF, charges an annual expense ratio of 0.40% based on the trust's daily net asset value (NAV). Therefore, the management fees will increase in tandem with higher gold prices.

Though rare, there is a possibility that a gold ETF might not perfectly track the price of gold due to factors such as fund expenses or inefficiencies in the market. This could lead to discrepancies between the ETF’s performance and the actual price of gold.

While gold ETFs allow quick exposure to the gold price without the need to own physical gold, investors are subjected to counterparty risk from the financial market, fund management, financial regulators, etc.

Alternatively, investors can purchase gold mutual funds, which pool money from investors to buy gold-related assets such as gold stocks and gold ETFs.

Gold Mining Stocks

Investing in gold mining stocks allows investors to indirectly gain leveraged exposure to the gold market. These stocks represent shares in companies engaged in gold exploration, mining, and production.

However, the value of gold mining stocks may not necessarily correlate with gold prices as they are heavily dependent on several factors, such as company management, jurisdictional friendliness of the mining operations, geopolitical and regulatory risks, environmental concerns, and operational risks.

If a gold mining company does well in most of these areas and sees its earnings grow, gold stock investors may receive windfalls from outsize returns compared to simply owning gold bullion or gold ETFs. The greatest capital gains are likely found in junior mining companies involved in gold exploration. Their share prices are very low because they have yet to strike gold. Upon the news of their discovery of gold, their share prices can skyrocket quickly, leading to outsized gains. However, junior mining companies also carry the highest failure risk in the gold mining industry, given their lack of fiscal strength and high operational costs.

Many established gold mining companies pay dividends, offering investors an additional income stream. This makes gold mining stocks appealing to those looking for gold exposure and the potential for regular payouts, which physical gold and ETFs cannot provide.

However, venturing into gold stocks is not for the uninitiated, as the industry is fraught with many risks that can easily derail the earnings of gold companies. Gold mining stocks are subject to various operational risks, such as mining accidents, labor strikes, equipment failure, or natural disasters. These risks can disrupt production and negatively impact profitability, leading to volatility in the stock price.

Many gold mining companies operate in countries with political instability, regulatory changes, or unreliable legal systems. Nationalization of mines, environmental regulations, or political conflicts can severely impact a mining company's operations and profitability.

Valuing gold mining companies can be more complex than simply tracking the price of gold. Factors such as the company's reserves, production costs, debt levels, and potential for future exploration must be considered. This requires more due diligence and analysis compared to straightforward gold investments.

Gold Futures

Gold futures provide an alternative way to invest in gold without physically owning the metal. They are derivative contracts that obligate the buyer to purchase, or the seller to sell, a specific amount of gold at a predetermined price and date in the future. For seasoned investors, gold futures can offer several advantages, but they also come with significant risks and complexities.

Like gold ETFs, gold futures provide exposure to gold prices but do not involve physical ownership of the asset. For investors seeking the safety and security of holding a tangible asset, futures may not meet their investment goals, especially in times of financial crisis.

Institutional investors, miners, and other market participants commonly use gold futures to hedge against price fluctuations in the gold market. The goal is not to profit from gold price movements but to manage or mitigate price risk. This is done by entering into a futures contract that will offset the gains or losses experienced in the physical market or from other investments tied to the price of gold.

Gold futures are highly liquid instruments, with active trading on exchanges like the COMEX (part of the CME Group). This liquidity makes it easy for investors to enter and exit positions quickly, allowing for greater flexibility in managing investments or trading strategies.

One of the main attractions of gold futures is leverage. Investors can control a large amount of gold with a relatively small capital outlay, known as margin. This allows investors to amplify potential gains since they are only required to deposit a fraction of the contract's total value upfront. However, while leverage can amplify gains, it also magnifies losses. A small adverse move in the price of gold can lead to substantial losses, often exceeding the initial margin deposit.

If the market moves against an investor's position, brokers may issue a margin call, requiring the investor to deposit additional funds to maintain the position. Failure to meet margin requirements can result in the forced liquidation of the position at a potentially unfavorable price, leading to significant losses.

Trading gold futures is more complex than simply buying gold bullion or ETFs. Futures contracts require a deep understanding of the market, leverage, and technical analysis and are unsuitable for novice investors.

Digital Gold

Digital gold is often offered through investment platforms that are geared towards convenience, allowing investors to buy and sell gold using their mobile devices easily without the need to own physical gold.

Many digital gold products allow retail investors to purchase gold fractionally and regularly accumulate it in a gold savings account, essentially a dollar cost-averaging investment strategy over time.

As digital gold trading platforms can be created and offered by any private company through mobile apps, it is important to exercise due diligence to ensure the credibility of such platforms and understand the potential risks of such gold investment products.

Research of the company's management team is necessary to gauge their experience in the gold market and track record in the business world. This is especially important if the gold trading platform claims physical gold backing for its investment product, as managing physical gold will require proper storage, insurance, audit, and testing. Only when these essential areas of gold vaulting are professionally and transparently handled can investors begin to trust a digital gold investment platform.

It is also common for new digital gold platforms to offer free gold storage as an incentive to gain market share from inexperienced retail investors who are mainly seeking the lowest investment cost. However, one must question how the digital gold platform will bear the logistical and operational costs of backing its product with physical gold and how this will affect its profitability. Investment veterans understand that a company's long-term profitability is crucial for longevity in the business world. Perhaps it is important first to ascertain the company's claims that physical gold is present and if there is sufficient gold to fully back the digital gold product. Unsustainable, low-priced products that benefit investors often lead to financial difficulties and the eventual demise of companies.

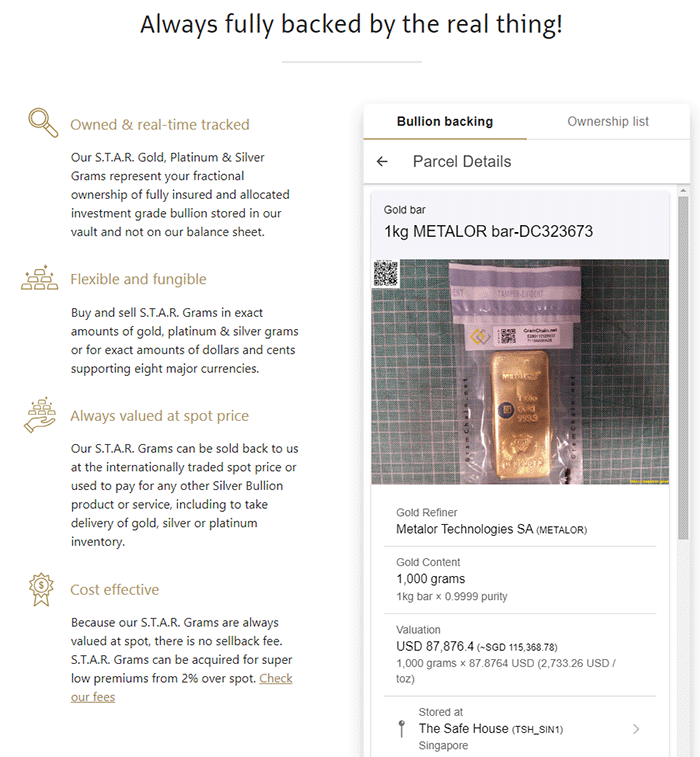

Silver Bullion's S.T.A.R. Grams is an example of a credible digital gold platform. On it, investors can conveniently buy fractional gold (silver and platinum as well) with their mobile devices. S.T.A.R. Grams are 100% backed by physical gold bullion stored at the company's vault, The Safe House, in Singapore. Investors can verify S.T.A.R. Grams' gold backing by perusing the bullion backing page on its website. All physical gold is uniquely identified using serial numbers and photos of the gold are also viewable.

Precious metals stored at The Safe House vault are also checked via quarterly bullion audits conducted by independent third-party bullion auditors, verifying their existence in the vault. The subsequent bullion audit reports produced are also transparently published on the website.

The high degree of transparency and well-designed checking mechanisms make S.T.A.R. Grams one of the best digital gold investment products available today.

Conclusion

As gold becomes increasingly important to central banks as a reserve asset, interest in gold will undoubtedly rise in tandem among investors. While many types of gold investments are available today, investors will need to assess their investment objectives and risk tolerances to select the most suitable gold investment product. Regardless, gold investing does not need to be overly complicated as the yellow metal is easiest to possess when owned physically. Afterall, history attests to gold's time-tested and trusted role as money and a reliable store of wealth that insures against the worst of financial crises.