Best Silver Bars to Buy for Investment (Updated 2024)

Investing in precious metals like silver can be a wise decision for those looking to diversify their portfolio and hedge against inflation. Silver bars are a popular choice for investors, as they offer a tangible asset that can be easily stored and traded. However, with so many options available, it can be difficult to know which silver bars are the best to buy for investment purposes. In this article, we will take a closer look at some of the best silver bars to buy for investment.

Why Invest in Silver Bars?

Before diving into the specifics of which silver bars to buy, it's important to understand why investing in silver can be a smart choice. Silver has a long history as money, from ancient to modern times. It has been used more often as money than gold.

Categorized as a precious metal, like gold and platinum, silver does not corrode and is rare in the Earth's crust. Like gold, silver's rarity and inherent properties made it a natural choice as money.

When it comes to choosing between silver bars or coins, the bullion industry is often consistent in one respect—the larger the precious metal product, the lower the price premium. With investment, your goal is likely capital appreciation gain. Therefore, you would want to buy silver at lower premiums.

What is a price premium?

It is the amount you pay for a silver bullion product above the spot price of silver. For example, if the silver spot price is USD $30 per troy ounce but the bullion dealer's silver bar is selling at a rate of USD $32 per troy ounce, then the price premium is USD $2 over the silver spot price (or 6.7% above spot). When silver prices rise, you would want the premium to be as low as possible for the quickest capital gain potential.

It is common for silver coins to be minted to a weight higher than one troy ounce. Although there are exceptions where larger silver coins are produced, they are uncommon and are not produced in the quantities of 1-oz silver coins. Therefore, silver investors wanting a lower price premium would have to consider buying silver bars since silver bars are produced to a maximum weight of 1,000 troy ounces.

For example, an American Silver Eagle 1 Oz Coin could have a 20% premium over the silver spot price compared to the 2.6% premium of a 1,000-oz silver bar.

Therefore, silver bars are excellent investment options if you prioritize investment returns over aesthetics. They are of the same quality as silver coins and have 99.9% silver purity.

Factors to Consider When Buying Silver Bars

While buying silver bars is a simple process, there are different factors to consider. No two silver investors are the same, and they will likely have unique preferences when buying silver. Here are some considerations when choosing the right silver bars to buy.

A. Minted Versus Cast Bars

The precious metals industry generally produces two types of bars, minted or cast bars, regardless of whether they are gold or silver.

While minted and cast bars are produced to the same silver purity and weight, their main difference is aesthetics.

Minted silver bars can have beautifully crafted designs with polished or matte surfaces, while cast silver bars are hand-poured, rough-looking bars with many imperfections like scratches and indentations. Remember, both types of silver bars have the same quality in terms of the amount of silver. They differ in looks.

Another difference is the price premium, with minted bars costlier than cast bars, given the higher manufacturing cost. However, bullion dealers can offer a higher sell-back price for minted silver bars. It is best to do your calculations for both types of bars, considering their buy and sell prices, to accurately assess which is a better investment buy.

B. International Recognition

Beyond aesthetics, it would be good for you to research where the different brands of silver bars are from. Precious metal refineries hail from many countries like Switzerland, Turkey, Germany, China, the United States, and Australia.

A common way to assess a refinery's quality is using the Good Delivery List of the London Bullion Market Association (LBMA), an international trade association representing the gold and silver bullion market. Precious metal refineries accredited by the LBMA and listed in the Good Delivery List are assessed to have met the stringent Good Delivery standards, and their silver and gold bars are acceptable in contract settlement for traded bullion physically held in London.

Refiners must undergo stringent checks on their history in the market, company financial standing, and ability to produce bars that meet the LBMA's exacting standards. They are also required to meet the LBMA's minimum production levels.

In addition, the LBMA requires accredited refiners to adhere to its Responsible Sourcing Program and produce bars that meet its Good Delivery Rules and are shipped to approved London vaults.

Silver bars produced by LBMA-accredited refiners are internationally recognized and are likely to be more liquid when you sell your silver bars.

As an investor, you have peace of mind knowing that your purchased silver bullion bars are produced by an LBMA-accredited refiner or mint.

C. Tax Benefits

There may be tax benefits when you buy silver bullion coins and bars depending on the country where you purchase. Countries like Singapore have exempted the sales tax or value-added tax (VAT) from investment-grade precious metals. These countries often establish precious metal tax-exemption policies based on the LBMA's Good Delivery Rules.

Unbeknownst to bullion industry novices, many private mints and refiners, especially in the United States, are not LBMA-accredited. Buying bullion online from such refiners may incur the sales tax if the importing country references the LBMA Good Delivery Rules in their precious metal tax policies.

Famous brands like the Perth Mint, Nadir, Argor-Heraeus, Heraeus, Valcambi, Metalor, and PAMP Suisse are LBMA accredited.

At Silver Bullion, almost all the bullion products we sell are from LBMA-accredited refiners and mints. When you buy their products online through our website, there is no Goods and Services Tax (GST), Singapore's sales tax, to be paid.

Best Silver Bars to Buy for Investment

So, what are our recommendations for the best silver bars to buy for investment purposes? While many recommend silver bars based on their brands, we believe the size of the silver bar should be the first consideration when you buy silver bars. This is because a silver bar's size affects the price premium, affecting the return on your silver investment.

The silver bar brand is also important, and buying from reputable refineries ensures you always purchase high-quality silver bars.

Here are our top picks for silver bars:

1. LBMA 1,000 oz Good Delivery Silver Bars

The massive LBMA 1,000 oz Good Delivery Silver Bar (about 32.1 kilograms) is our top recommendation for silver investment. While it is rarely among the top silver bars recommended by other bullion dealers, our more than a decade of experience in the bullion industry convinced us that this is the best silver bar for investment.

As mentioned, an investment is an asset acquired to generate returns or gain appreciation. From this perspective, the best returns from silver bars are obtained when the product has the smallest spread and the lowest price premium. LBMA 1,000 oz silver bars fulfill these criteria much better than other silver bars, having the lowest premiums and smallest spreads.

LBMA Good Delivery 1,000 Oz silver bars

Unlike minted silver bars, which aim for aesthetic appeal, albeit with wider spreads and higher price premiums, LBMA 1,000 oz silver bars are cast bars (or hand-poured bars) with a rough appearance. Due to the lower cost of producing these large silver bars, the premiums and spreads are also lower, allowing them to give silver investors the best returns when silver prices rise.

Another advantage of buying LBMA 1,000 oz Good Delivery Silver Bars is that they are refined according to the stringent and trusted Good Delivery standards of the London Bullion Market Association (LBMA), which enable the global trade of silver bars. Each bar must have markings showing the serial number, fineness, and the refiner's stamp.

A peculiar feature of LBMA 1,000 oz Good Delivery Silver Bars, also known as loco London silver bars, is that they are often not exactly 1,000 troy ounces of silver. The London Bullion Market Association (LBMA) Good Delivery Rules recommend that precious metal refiners should aim to produce bars with a minimum and maximum gross weight of 900 troy ounces (approximately 28 kilograms) and 1050 troy ounces (approximately 33 kilograms).

When you buy LBMA Good Delivery 1,000 oz silver bars, you are assured that the refiner is listed in the LBMA Good Delivery List and that the silver bar is produced to the highest quality following the stringent Good Delivery Rules. Moreover, these bars allow for the best investment returns, given their low premiums and small spreads.

You can purchase LBMA 1,000 oz Good Delivery Silver Bars from Silver Bullion, with the option for vault storage for added convenience. Upon placement of your order and payment for in-stock bars, the price will be adjusted to the actual weight of the silver bar assigned to your order.

2. 15 Kg Silver Bars

If the 1,000 troy-ounce silver bars (about 482.26 Oz) are too unwieldy for your liking, the next best big silver bar option is the 15-kilogram silver bar (about 482.26 troy ounces). Remember that lower price premiums and smaller buy-sell spreads are often inherent with larger silver bars, given their lower production costs.

Like the 1,000-oz silver bars, they are produced as cast bars (or hand-poured bars), having a rough appearance with scratches and unevenness. As bullion silver bars are aimed at investment and are not collectibles, silver cast bars are mainly valued for their silver weight and purity—the two important qualities for their investment value. Having a nice finish is not essential for investment-grade silver bars.

15 Kg Silver Bars can be easily carried by a single person compared to the 1,000 oz Silver Bar, having one of the lowest premiums and smallest spreads. They are also refined to exactly 15 kilograms in weight unlike the 1,000 oz Silver Bars.

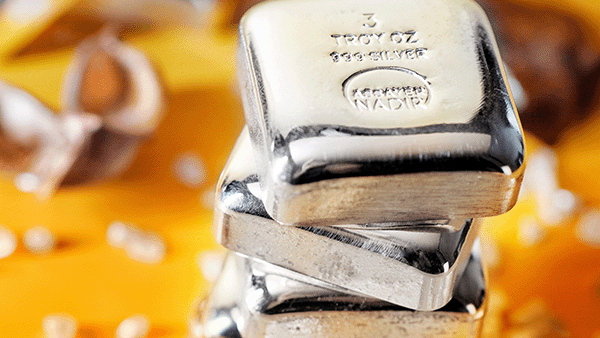

At Silver Bullion, 15 Kg Silver Bars with 99.9 purity are available from Nadir Metal Rafineri and Heraeus, both LBMA-accredited precious metal refineries.

3. 100 Oz Silver Bars

If you find the 15-kilogram silver bars (about 3.11 kilograms) still too large for your silver investment, you can consider buying the 100-troy-ounce silver bar - one of the most popular products among retail buyers from our experience.

While the 100 Oz Silver Bar premium is higher than the 1,000 Oz and 15 Kg Silver Bars, it strikes a good balance between price and portability. Moreover, 100 Oz Silver Bars may give you more liquidation options when it is time to sell your silver bars. Imagine having five 100 Oz Silver Bars compared to a 1,000 Oz Silver Bar, both 500 oz. The former allows you to sell up to five different times, possibly taking advantage as silver prices rise and averaging up your profit. With the latter, you only have one option to sell.

Compared to the larger silver bars, 100-oz silver bars offer more brands to choose from. They are produced by government mints and private refineries, such as the Royal Canadian Mint, the Perth Mint, Nadir, Argor-Heraeus, Johnson Matthey, and Valcambi. Choosing between brands comes down to individual preferences regarding aesthetics and the country of origin since all these brands are internationally recognized, allowing your silver bars to be easily sold worldwide.

At Silver Bullion, popular 100 Oz silver bars often purchased by our customers at our bullion retail store and online include the Nadir, Royal Canadian Mint, and Johnson Matthey silver bars.

Johnson Matthey 100 Oz silver bars

4. 1 Kg Silver Bars

With the 1 Kg and smaller silver bars, you will notice higher price premiums from 7 percent above the silver spot price. From our experience, buyers of smaller silver bars, like the 1-kilogram silver bars (about 32.15 Oz), are usually constrained by budget or have a greater preference for portability.

Usually produced in sizes smaller than a smartphone, allowing them to be easily carried anonymously by an individual, 1 Kg Silver Bars are very portable. Owning smaller silver bars like the 1 Kg Silver Bars may make sense if you buy silver in a country with little political stability or societal safety since they are easier to transport. However, if your silver bars are stored in a safe country like Singapore, the larger silver bars should be considered if you are looking for better investment returns.

Given that 1 Kg Silver Bars are popular among retail buyers, they are available from many international refineries, with popular brands like Metalor, PAMP Suisse, Nadir, Heraeus, and the Perth Mint. You are assured of the silver bars' quality and 99.9% fineness as these refiners are internationally recognized and also LBMA-accredited.

While most 1-kilogram silver bars are produced as silver cast bars, some refineries also offer an aesthetically pleasing minted bar option, albeit at a higher price premium.

Heraeus 1 Kg silver bars

5. 10 Oz Silver Bars

10 Oz Silver Bars (about 311 grams) are commonly available in the bullion market in both minted and cast bars. Regardless, these bars have the highest premium compared to the other silver bullion bars on our list.

Despite the higher premium, they are still a good silver investment option for small-budget buyers since their premiums are much lower than those of silver coins.

Like the 1-kilogram silver bars, there are many brands to choose from, including well-established private refineries and government mints. The 10 Oz Royal Canadian Mint Silver Bars (minted bar) and the 10 Oz Nadir Silver Cast Bars are two of the most popular silver bars purchased by investors.

What Other Sizes and Weights of Silver Bars Are Available?

In addition to the ones mentioned above, here are the other silver bar sizes available on the market.

Remember that while smaller silver bars are nominally cheaper to buy, they have higher premiums than larger silver bars, given their size. If you are purchasing silver bars for investment, the larger bars will allow you to accumulate more silver ounces for your money.

Selecting the Best Silver Bars to Invest

Investing in silver bars is one of the best ways to begin holding precious metal hard assets in your investment portfolio. While the process of buying silver coins and bars is similar, silver bars can give better capital appreciation gains given their lower price premiums. If you want a sizeable position in silver, buying silver bars is the way to go, as you can buy more silver ounces than buying silver coins. Following our tips for buying silver puts you in an excellent starting position to begin your silver investment journey.

Where to Buy the Best Silver Bars

Silver bars can be purchased from your local bullion dealers or coin shops. Alternatively, you can buy investment-grade 999 fine silver bars from Silver Bullion via our website or at our Singapore bullion retail store.

Silver Bullion is one of the largest bullion dealers in Singapore and has been in the silver bar market for over 15 years. It is a member of the London Bullion Market Association (LBMA) and the Singapore Bullion Market Association (SBMA), attesting to our active participation and trust received in the precious metals industry.

When you buy precious metal products from us, you have absolute peace of mind knowing that your products are genuine. You can also sell them back to us at any time without questions asked. Please create a precious metal account at our website to buy precious metals for your investment portfolio!