This Might Be the Last Time Gold and Silver Are at These Prices

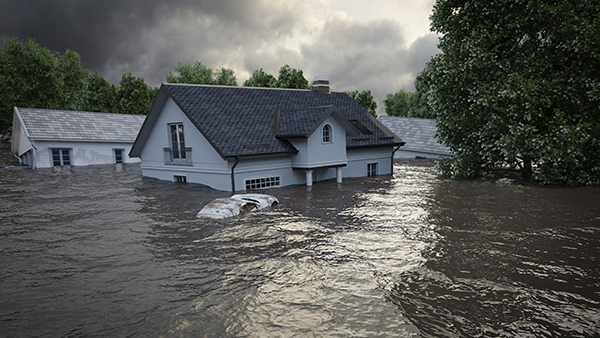

"The river dragon has come!"

This was one of the final haunting cries heard by survivors of the massive flood caused by the collapse of 62 dams due to Typhoon Nina in China, a catastrophic disaster known as the 1975 Banqiao Dam failure. The collapse of the dam unleashed a moving wall of water six meters high and twelve kilometers wide. Behind this massive moving wall of water was a further 600 million cubic meters of water.

The collateral damage was unimaginable – 240,000 dead, two million people trapped, and eleven million stricken by disease, food poisoning, and famine in the aftermath. It remains the world’s worst human-made catastrophe today.

Banqiao Dam, the largest of the dams, was designed to protect against a 1000-year flood – one created from a storm that would drop 0.53 meters of rain over three days. However, Typhoon Nina dropped a meter of water in three days, tipping the pressure that could be withstood by the dam. Banqiao dam broke, and the deluge led to the cascading collapse of other downstream dams exacerbating the disaster.

Today, our financial system is like a dam holding back a massive reservoir of debt created by central banks raining money printed out of thin air. This dam has contained this credit within its limits for decades, but signs of cracks have appeared. One major crack resulted from the Global Financial Crisis of 2008. The eurozone debt crisis that began in 2010 was another. In recent times, one of the most apparent cracks was the repo-crisis of September 2019. The Federal Reserve’s response to plaster over this crack was to pump $500 billion into the financial system. For comparison, the QE1 bailout was $600 billion.

As the Federal Reserve thought they had stabilized markets with their money printing, the coronavirus typhoon hit the global economy. The central bank’s response to quell this new storm saw them printing even more money. This time, the size of the bailout truly boggled the mind. If you spent $1 million a day since the year zero, you would NOT have spent $1 trillion by 2020.

Yet, the Federal Reserve created $3 trillion in three months!

It is time we awake to the pressing fact that we are witnessing the greatest currency debasement experiment in humankind’s history. Just as a dam has a limit to the amount of water it can hold, our financial system has a limit for debt before all hell breaks loose. A tipping point will come when the massive sloshing credit crests the dam resulting in market confidence plunging, leading to a total collapse of the financial system.

Given the unprecedented scale of the money printing, the fallout from this collapse will no doubt be the most devastating in humankind's history. People who do not understand the magnitude of this coming disaster or have not protected their wealth with gold, silver, and other hard assets are akin to living below the dam. They have significant exposure to systemic risks from the financial system. Those with gold and silver bullion in a safe jurisdiction have begun their escape from the path of this coming flood.

Protecting one’s wealth has never been more critical. The current correction in gold and silver prices is a bonus to do so. This correction could be one of the last before we bid sub-$2000 gold prices and sub-$30 silver prices goodbye. Take action now before it is too late. Head for the hills.