Top 10 Countries With the Highest Gold Reserves (2022)

In global economics, gold reserves are not just a measure of affluence but a cornerstone of monetary stability and international influence. The amount of gold a country holds is a significant indicator of its economic health and ability to withstand the most severe of financial crises. Despite gold being largely relegated to being a secondary asset today, often held very little as a percentage of many countries' foreign reserves, a nation's gold reserves play a key role in the country's financial stability, offering a buffer against market volatility and currency fluctuations.

Definition Of Gold Reserves

Gold reserves refer to the precious metals that countries hold as part of their foreign reserves. Gold is considered a safe-haven asset that central banks keep as a reserve of safety against economic uncertainties that could arise from paper money. It is also highly liquid, making it easy to trade during times of need.

A country's gold reserves can impact its currency value, influence foreign exchange rates, and provide reassurance to international investors and other countries that it is an excellent jurisdiction for investment.

Sovereign gold holdings are usually in a standardized form, often as 400 troy-ounce gold bars with a purity of 99.5% or higher, to facilitate trading and valuation on the international gold market.

Top 10 Countries With the Highest Gold Reserves as of 2022

As of 2022, these are the highest gold reserves by country in the world according to World Gold Council data:

- United States

Gold Reserves: 8,133.5 metric tons

Percent of Foreign Reserves: 67.1%

The U.S. has the largest gold holdings in the world, nearly equal to the next three countries combined. The majority of its gold is held at Fort Knox, Kentucky, and other locations like the Philadelphia Mint and Denver Mint. - Germany

Gold Reserves: 3,355.1 metric tons

Percent of Foreign Reserves: 66.5%

Germany completed a significant repatriation of its gold reserves in 2017, moving gold from France and the U.S. back to its own vaults. The country has seen a steady rise in gold investing since the 2008 Global Financial Crisis. - Italy

Gold Reserves: 2,451.8 metric tons

Percent of Foreign Reserves: 63.6%

Italy's gold reserves have been stable over the years. Contrary to the common practice in many countries where the state owns the sovereign gold but entrusts its management to the central bank, in Italy, the gold is officially owned by the country's central bank, Banca d'Italia (Bank of Italy), rather than being the property of the Italian State. - France

Gold Reserves: 2,436.8 metric tons

Percent of Foreign Reserves: 58.6%

France's central bank, Banque de France, manages the country's gold reserves and is responsible for its secure storage. Most of these reserves are kept in the Souterraine, an extremely secure vault 27 metres underground. The Banque de France vaults are also one of the designated depositories of the International Monetary Fund (IMF). - Russia

Gold Reserves: 2,332.7 tonnes

Percent of Foreign Reserves: 23.4%

A portion of Russia's gold reserves held abroad were seized by Western central banks in March 2022 due to sanctions related to the conflict in Ukraine. The remaining gold holdings are kept within Russia. - China

Gold Reserves: 2,010.5 metric tons

Percent of Foreign Reserves: 3.6%

Despite being sixth in gold holdings, China has a relatively small percentage of its reserves in gold. The People’s Bank of China revealed that it bought gold in December 2022, the first time it has disclosed an increase since September 2019. - Switzerland

Gold Reserves: 1,040.0 metric tons

Percent of Foreign Reserves: 6.6%

Despite being ranked 7th in terms of total reserves for gold, Switzerland has the world's largest gold refining and transit hub. - Japan

Gold Reserves: 846.0 metric tons

Percent of Foreign Reserves: 4.0%

As the world's third-largest economy, Japan also holds a significant amount of gold. Its central bank's aggressive quantitative easing policies have helped fuel global demand for gold. - India

Gold Reserves: 787.4 metric tons

Percent of Foreign Reserves: 8.1%

India's central bank, the Reserve Bank of India (RBI), stores part of the nation's gold in its building's gold vaults in Nagpur, while the remainder is stored with the Bank of England and the Bank of International Settlements (BIS). - Netherlands

Gold Reserves: 612.5 metric tons

Percent of Foreign Reserves: 56.4%

The Dutch central bank stores the nation's gold in the Dutch National Bank's gold vault and various locations around the world, such as New York's Federal Reserve Bank, the Bank of Canada, and the Bank of England.

Why Central Banks Buy Gold

Central banks around the world purchase gold for several strategic and economic reasons. Primarily, gold represents a safe-haven asset that provides financial security during periods of economic instability. Unlike fiat currencies, which can be prone to inflation and are subject to the control of governments, gold maintains intrinsic value. This enduring value makes it a reliable store of wealth and a hedge against inflation and currency devaluation. In times of economic uncertainty, such as during high inflation or currency crises, gold often retains its worth or even appreciates in value, stabilizing national reserves.

Moreover, gold plays a crucial role in diversifying a country's reserves. Central banks aim to hold a mix of assets to mitigate risks associated with any single type of asset. By including gold in their reserves, central banks can reduce their exposure to fluctuations in major currencies like the US dollar or the Euro. This diversification is particularly important for countries looking to reduce their dependence on a single foreign currency, which might be subject to geopolitical tensions or unilateral decisions by other nations.

Additionally, owning substantial gold reserves enhances a country's economic clout and credibility in the international financial system, providing a foundation for confidence in the country's currency and economic stability.

How Much Gold Did Central Banks Buy in 2022?

According to the World Gold Council, 2022 was the "strongest year for gold demand in over a decade." The annual gold demand in 2022 was 4,741 metric tons, an 18% increase (excluding OTC). In particular, Q4 had a record gold demand of 1,337 metric tons.

While gold jewelry consumption was marginally lower, down 3%, in 2022, gold investment demand grew by 10% - a nine-year high. Global gold bar and gold coin demand rose by 2% to 1,217 metric tons. Gold-backed ETF holdings fell by 110 metric tons, albeit significantly lower than the 189 metric tons of net gold selling in 2021.

The increase in purchases of gold coins and bars was driven by the need for wealth protection amidst the global inflationary environment.

Central bank purchases hit a record high of 1,136 metric tons in 2022, the highest level of annual demand since 1950. 2022 was also the thirteenth consecutive year of net gold purchases by central banks.

According to the World Gold Council's findings, geopolitical uncertainty and high inflation were cited as the key reasons for the increase in gold stockpiling. Central banks were incentivized to buy gold because of the yellow metal's "performance during times of crisis and its role as a long-term store of value."

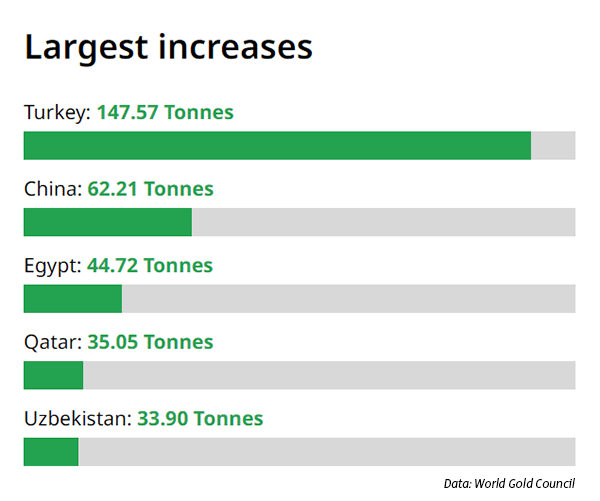

Which Country Bought the Most Gold in 2022?

Despite mining over 40 tonnes of gold per year on average, Turkey bought the most gold in 2022. The Central Bank of Turkey reportedly increased its gold reserve by 148 metric tons to the highest total gold reserves on record at 542 metric tons.

Following a hiatus of almost 25 years, the Central Bank of Turkey began buying gold aggressively in the gold market in May 2017. The country became the second-highest purchaser of gold in 2017, 2018 and 2019. In 2020, Turkey was the fourth-highest gold buyer. Having accumulated the most gold reserves on record last year, the precious metal represented 29% of Turkey's foreign exchange reserves.

Nonetheless, this extensive gold purchasing has led to a significant deficit in Turkey's current account, the most comprehensive indicator of trade and investment. In 2022, the nation's current account deficit expanded to $48.8 billion, of which gold imports constituted $20.4 billion.

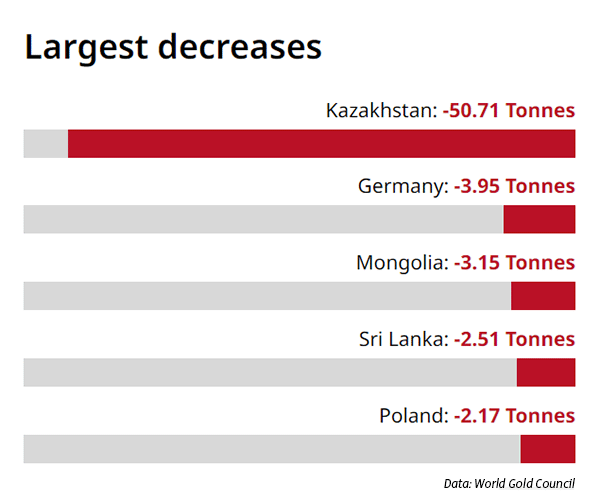

Which Country Sold the Most Gold in 2022?

The National Bank of Kazakstan (NBK) was the largest gold seller in 2022, reducing its gold reserves by 51 metric tons to 352 metric tons. Gold represents 58% of Kazakstan's foreign exchange reserves. Despite the sale, Kazakstan has the 15th largest gold reserves according to World Gold Council data.

The NBK said the gold sales were to "diversify and ensure balance in the allocation” of reserves and to “replenish the foreign-currency part of the reserves, which is invested in highly liquid instruments in external markets.”

The Central Asia country mines and refines about 70 to 80 metric tons of the yellow metal annually. Kazakstan refineries, namely Kazakhmys Smelting LLP, Kazzinc LLP and Tau-Ken Altyn LLP. Gold refined to the international London Good Delivery (LGD) standard is currently produced by Kazzinc LLP and Tau-Ken Altyn LLP.

In 2022, the largest gold export by volume was 2.2 metric tons to Kyrgyzstan.

China Resumes Buying Gold in 2022

The People’s Bank of China (PBoC) made a significant announcement by the end of the year, reporting the first increase in Chinese gold reserves since September 2019. 62 metric tons of gold were purchased, raising its gold holdings to over 2,000 metric tons for the first time to its largest gold reserves on record of 2,010.5 metric tons.

Which Countries Have the Least Gold as of 2022?

Despite gold's important role as money and as a safe haven asset in history, World Gold Council data showed that there are 12 countries with zero gold reserves as of 2022.

These 12 countries that have the least gold are:

- Canada

- Norway

- Azerbaijan

- Costa Rica

- Nicaragua

- Armenia

- Cameroon

- Gabon

- Turkmenistan

- Congo

- Chad

- Eritrea