Where is the New Volcker, and Why Should We Care?

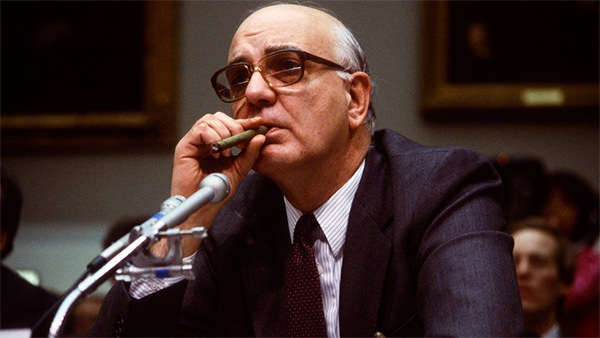

History occasionally sees the right people in power rescue their country from calamity. Paul Volcker, the Federal Reserve Chairman who beat inflation in the early 1980s, was one of these people.

While it might be argued that Volcker helped to create the problem in the first place, by being part of the 1971 “Nixon shock” team which engineered the severing of the link between the dollar and gold, he nonetheless managed to reign in big banks and beat inflation when it was most needed.

By 1982, he had raised interest rates to over 22% to stop inflation and restored faith in the gold-less dollar. While he was highly criticized at the time, as his policies caused unemployment levels to surpass 10%, he had set the US economy on a firm foundation of stability and prosperity leading to the dollar regaining value in people’s minds.

However, when Volcker fought his inflation battle, the total US Government debt was around 0.91 trillion USD and inflation was at 14.8%. With a 227 million population, each person had an average debt of 4,000 USD. Volcker did such a good job at making the USD scarce, and therefore valuable, that the dollar remained the world’s trusted reserve currency for the next 40 years.

Today, that trust reservoir is running on reserves as the debt per person is 87,700 USD today and increasing by 8,000 to 10,000 USD per year. It took the United States 204 years to accumulate the 0.91 trillion USD debt which Volcker defended; forty years later, the United States is increasing its debt by the same 0.91 trillion USD in the past 4 months alone - a 61,200% increase in debt-creation speed.

With “official US inflation numbers” reaching their highest rates since 1982 (6.8% p.a.) as of November 2021, it is becoming obvious that today’s US dollar is on much shakier foundations than in 1980. Volcker himself died in 2019 and it seems unlikely that today’s US Administration will be able to handle this nascent currency crisis without strong leaders like Volcker.

Higher Interest Rates Will End the Equity and Real Estate Booms

Given today’s political climate, the Fed will likely not raise interest rates fast enough to forestall inflation effectively, and US politicians seem intent on worsening the budget deficit, conveniently using faux “Modern Monetary Theories” to justify that those debts no longer matter. Hence, interest rates will likely be allowed to rise too slowly leading to Volcker’s worst nightmare - a persistent and self-reinforcing loss of trust in the dollar which leads to higher and higher inflation.

Regardless of policy details, interest rates will have to start rising soon and we are almost certainly entering a period of stagflation featuring slowing economic growth and rising inflation. In a stagflation:

1) Bonds and cash tend to be terrible stores of value because inflation, in the absence of Volcker-like policies, tends to be higher than nominal returns, causing a guaranteed loss in real purchasing power for their holders.

2) Real estate will suffer as buyers are usually highly leveraged (via mortgages) and rely on low-interest rates to justify high real estate prices. In a stagflation, people tend to lose their incomes while their mortgages become a lot more expensive as interest rates rise.

3) Equities are near all-time highs, buoyed by cheap money and leveraged margin as many investors borrow money from their brokers to buy stocks. Low growth will therefore lower company earnings and dividends while falling stock prices and bankruptcy fears will cause margin positions to be force-closed, thus, accelerating the fall.

Most bonds (relative to real interest rates), real estate and equities are very expensive or near all-time highs today. Precious metals and commodities are some of the few obvious value investments left. Historically, they are also the best assets to hold in a stagflation. Hence, it is likely not a coincidence that more sovereign entities, including the Singapore Government, have prudently started to increase their gold reserves this year.

Gold and silver might not pay interest, but they are appreciating assets (on average having a 7.8% and a 4.8% p.a. gain respectively over the past 50 years) and they are safe haven assets. Moreover, if properly stored, its value will hold against any calamity. Precious metals have survived wars, recessions and much-touted hype from competing assets for thousands of years and they continue to be central to our financial system today.

Demagogues, “Pass-the-baton” Politicians and Strongmen

After decades of ever-increasing deficits, most Western politicians do not view high deficits as a problem and feel entitled to spend public funds without restraints, supported by faux monetary theories that they can later use to deflect their responsibility.

In today’s environment, leaders who are able to understand complex issues and act decisively to push through the unpopular medicine to stop a growing economic cancer seem to be utterly absent.

Many Western countries are also in a vicious cycle of ever-increasing debt, taxes and regulations that discourage productive activities and work. Ultra-cheap monetary policies, unfunded social promises and ever greater deficits have become an unhealthy addiction that allows politicians to delay making unpopular but necessary decisions. It is akin to a patient putting off treatment and not taking the needed medicine.

Strongmen like president Erdogan in Turkey even forced the central banks to lower interest rates in the midst of a growing currency crisis, which is akin to trying to stop a fire by throwing gasoline on it.

What these demagogues, “pass-the-baton” politicians and strongmen don’t seem to understand is that their power is derived entirely by their subjects’ faith in the issued fiat currency and that it will all collapse once this trust is questioned.

So, where is the Volcker of our generation - someone with bigger cojones to tackle the largest deficits and debt problems in mankind’s history? Unfortunately, we will likely see a new Volcker arise only past the eleventh hour when the debt crisis has spiraled out of control.